Owner's Draw In Quickbooks Self Employed

Any money an owner draws during the year must be recorded in an owner’s draw account under your owner’s equity account. At the end of the year or period, subtract your owner’s draw account balance from your owner’s equity account total.

Quickbooks Owner Draws Contributions - Youtube

Corporations if your business is formed as a c corporation or an s corporation, you will most likely receive a paycheck just like you did when you were employed by someone else.

Owner's draw in quickbooks self employed. Owner's capital includes any of the investments, profits, retained earnings and other funds that belong to the company owner. The only reason i have payroll is because i hired an employee. This is not necessarily true for more complicated business entities.

Step 5 enter the total for the withdrawal in the amount column of the expenses tab. Technically, an owner’s draw is a distribution from the owner’s equity account, an account that represents the owner’s investment in the business. Select the gear icon at the top, and then select chart of accounts.

Instead, you would make owner's draw using an equity account and no withholdings. From an accounting standpoint, owner’s draws are shown in the equity portion of the balance sheet as a reduction to the owner’s capital account. A member’s draw, similarly called an owner’s draw or partner’s draw, records the amount taken out of a company by one of its owners.

Also known as the owner’s draw, the draw method is when the sole proprietor or partner in a partnership takes company money for personal use. To record owner’s draws, you need to go to your owner’s equity account on your balance sheet. On the income statement the owner's net income for the year is $10,000 and the owner withdrew $40,000 as owners draw.

Hello, @god is love towing llc. You also will file a schedule se which determines your self employment tax, an additional tax beyond the income of the company. If not, go to your chart of accounts to create a new account and select equity as the type.

Owner’s equity is made up of any funds that have been invested in the business, the individual’s share of any profit, as well as any deductions that have been made out of the account. If you're a sole proprietor, you must be paid with an owner's draw instead of employee paycheck. You can either enter a check/expense and.

Quickbooks records the draw in an equity account that also shows the amount of the owner’s investment and the balance of the owner’s equity. We’re not drawing in permanent marker depending on your business type, an owner’s draw isn’t the only way to pay yourself. Many small business owners compensate themselves using a draw, rather than paying themselves a salary.

Your taxes will be based on the net income of your business, where you file schedule c with your 1040. What is an owner’s draw? The benefit of the draw method is that it gives you more flexibility with your wages, allowing you to adjust your compensation based on the performance of your business.

Select petty cash or owner's draw, depending on the method you want to use to track funds. You should already have an owner’s draw account if you selected sole proprietor when setting up quickbooks. How to record owner's capital in quickbooks.

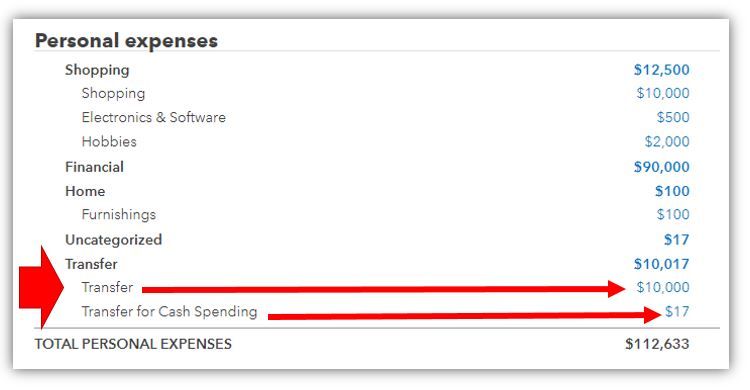

Therefore, your owner's draw has no tax consequences and does not need to be entered. The draw is a way for an owner to receive money from the. The 15.3% self employed se tax is to pay both the employer part and employee part of social security and medicare.

To create an equity account: You can draw by simply writing a check to yourself, anytime you want, and post it to out drawing account. The owner draws are recorded as negative entries against equity.

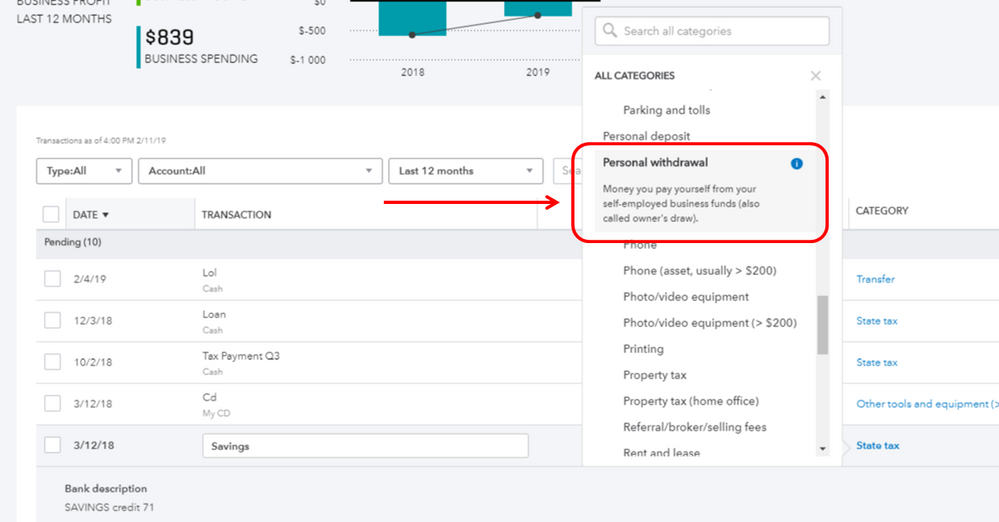

Patty could withdraw profits generated by her business or take out funds that she previously contributed to her company. An owner’s draw refers to an owner taking funds out of the business for personal use. Owner's draw on self employed qb.

And let's pretend you are properly set up with the irs and your state tax departments. I recently discovered that i should have been marking some of the owner draws as partly business use of the home expenses. Record your owner’s draw by debiting your owner’s draw.

When recording owner's capital, you can use a special account called an owner's equity account to track all related transactions. An owner's draw account is an equity account used by quickbooks online to track withdrawals of the company's assets to pay an owner. How to record transactions in the books when you pay yourself as a business owner.

Being year end i am wondering if i should calculate as a personal expense an interest calculation on an over extension of owners draw (sole proprietor business). You pay 15.3% for 2017 se tax on 92.35% of your net profit greater than $400. Transfers that you've tagged as business won't be included in.

Tax Vat For The Airbnb Hosts Go Self-employed Small Business Tax Business Tax Business Checklist

Ms Access Database Invoice Tracking Template Access Database Invoice Template Create Invoice

Freshbooks Review 2018 Try Cloud Accounting Software Free For 60 Days - Careful Cents Freshbooks Accounting Software Small Business Accounting

Solved Owners Draw On Self Employed Qb

Onpay Payroll Services Review Payroll Software Payroll Advertising Methods

Quickbooks Training -- Enter Quickbooks Sales Receipts Quickbooks Quickbooks Training Quickbooks Tutorial

Solved Owners Draw On Self Employed Qb

Learn About Recording An Owners Draw In Quickbooks Pro 2013 At Wwwteachucompcom A Clip From Mastering Quickbo Quickbooks Tutorial Quickbooks Quickbooks Pro

Setup A Draw From Quickbooks Self-employed

How To Pay Invoices Using Owners Draw

How To Pay Invoices Using Owners Draw

How To Record Owner Investment In Quickbooks Updated Steps

Using The Quickbooks App To Stay On Top Of Your Bookkeeping Small Business Finance Small Business Bookkeeping Personal Finance

Blog Ideas For Travel Next Writing Meaning On Hindi Small Business Bookkeeping Bookkeeping Business Small Business Finance

Setting Up The Quickbooks Chart Of Accounts Chart Of Accounts Accounting Quickbooks

How To Write A Tax Write Off Cheat Sheet Business Tax Tax Write Offs Business Marketing

Minutes Matter - In The Loop Paying Reimbursing Yourself In Quickbooks Chart Of Accounts Quickbooks Accounting

How To Record Owner Investment In Quickbooks Updated Steps

10 Free Spreadsheet Hacks And Templates That This Business Owner Swears By Excel Templates Business Small Business Finance Spreadsheet Business